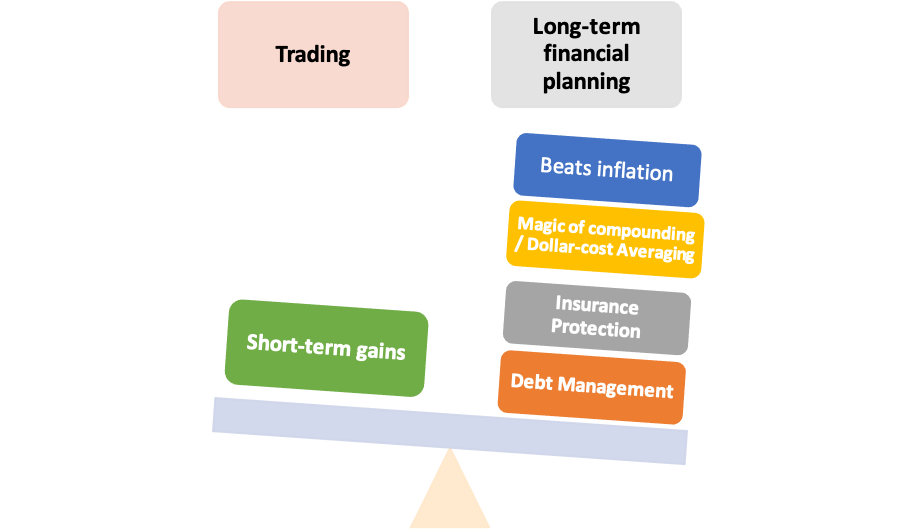

When you think of making money the most obvious choices that come into your mind are –Trading and Long-term Investing. But what you tend to miss out on is a more holistic approach known as Long-term Financial Planning. Veteran investor, Charlie Munger puts it beautifully- “The big money is not in the buying or selling but in the waiting.”

Well, we will come to financial planning later, but first, you need to understand what trading is and if it is the right path for wealth creation.

What is Trading?

Every form of making money differs in terms of the objective, capital requirement, acumen, and time commitment. If you want to park your money in securities to just reap returns from short-term asset price movements with a dose of excitement, trading is for you.

There is no capital requirement as such, but, in most cases you will need to maintain a balance of $25,000 in the brokerage account. Besides, you also have to pay a commission for each trade.

At the same time, there are certain new-age apps which attract millennial investors by eliminating account opening or brokerage charges completely for trading. However, the issue is not about the cost, it is about high risk exposure. If you indulge in trading regularly, they may get caught in a bubble or lose you savings while trying to speculate.

Since Trading depends on price fluctuation over a short period, you have to be actively involved and devote considerable time for observation.

To make the most of Trading, you need to strategize very well, be patient and risk-tolerant. The possibilities of making profits in Trading are huge. On good days, you can earn between 0.7%- 3% gains. However, the chances of ending up in losses are equally dominant. Luck also plays a major role when it comes to Trading.

So, why leave everything to chance and destiny when it comes to your hard-earned money?

| TRADING | LONG TERM FINANCIAL PLANNING | |

|---|---|---|

| Objective | Quicker & higher returns | Creating wealth over a long term, not impacted by volatility. Also reaping gains through dividends |

| Mindset | Triggered by impulse, greed, high appetite for risk | Driven by fundamentals behind a financial plan, ownership mindset, immense patience |

| Holding period | Few minutes to few hours | Few years to few decades |

| Costs | In most cases, minimum balance of $25,000 in brokerage account + commission on each trade. Some new age platforms do not charge anything | Relatively lower transaction costs as well as taxes |

| Drawback | High risk & probability of losses | Longer time frame to reap the benefits |

The most prudent way to create wealth is through a long-term approach. This is called Financial Planning. Here you don’t just restrict yourself to stocks but also explore other asset classes following your investment objectives. Additionally, you can save money in taxes, and shield yourself from eventualities through insurance.

Most people think financial planning is only for the ultra-rich. However, the truth is financial planning is a must for everybody irrespective of their income. You won’t be working forever, but you can earn forever, and that is possible only through financial planning.

Long-term financial planning takes a lot of factors into consideration and is a more dependable way of wealth creation compared to Trading.

Here are five reasons to show how:

Beating Inflation

One of the biggest factors that erodes your purchasing power is inflation. Inflation causes the value of money to deplete. Even if you are saving for your future goals, it may still be insufficient to meet the need when the time comes. To counter the inflationary forces from derailing your future goals, you must have an investment plan in advance. Countries like India have been grappling with the problem of inflation, so a strategised move is to invest in moderate to high-risk avenues like equities or mutual funds that offer inflation-beating returns as against traditional savings schemes.

Magic of compounding

Besides fulfilling your goals, one of the major objectives of financial planning is to lead a comfortable retired life. With no regular income, rising expenses, and age-related issues, retirement planning is only possible through a long-term approach. Say, you want to retire 20 years from now, then you must begin investing now and stay invested for long to enjoy the power of compounding. To put it simply, the returns on your investment for each year gets added to the principal amount for the next period. The combined amount thus keeps earning more returns with each passing year.

Dollar-cost Averaging

Equity investing is an integral component of financial planning. However, instead of indulging in Day Trading, Mutual Funds are a better way of reaping returns. Systematic Investment Plans or SIPs are the best ways to create wealth over some time through a technique called dollar-cost averaging that involves investing money in a fund at regular intervals over the long-term. This is a strategy that helps you to circumvent price fluctuations and over time the average cost per share would be lesser that what you have spent in trading.

Insurance Protection

We never know what eventuality will befall us in life. Safeguarding yourself and your loved ones from these unforeseen circumstances is crucial else it might deplete your savings. Long-term financial planning empowers you to protect your wealth through insurance. Though insurance planning is optional, it is one of the critical elements of your financial plan. It is a protective investment that shields you from any kind of financial loss arising out of death, accident, illness, theft, injury, or other damages. It is a kind of forced savings that reaps benefits over a long period. Even if there aren’t any mishaps, you or your nominees can still enjoy the maturity benefits at the end of the policy term.

Debt Management

You can never find peace in life even after fulfilling your goals if you have a huge debt burden on your head. This is because loans are financial commitments and a larger portion of it at a higher cost indicates a larger financial risk. A sound financial plan not only aims at wealth creation and protection over a period, it also ensures that you pay-off your debts in a systematic way. Mostly, you are encouraged to pay off the high-cost debt and negotiate the payment terms for the rest including the restructuring of the loan.

Bottomline

In a nutshell, long-term financial planning not only creates wealth for generations, it also protects you against financial losses from unforeseen circumstances. All this cannot be achieved by trading at all.

So, while trading in the short term can be exciting and occasionally rewarding, you can only build wealth by staying invested in the long term.

Before you approach your financial advisor, you must have a clear idea about your investment objectives and debts. This will help him to draw a strategised plan for long-term wealth building and ensuring consistent cash flows post retirement.