With rising awareness about environmental issues and corporate governance, investors are embracing a unique way of investing known as ESG Investing. Here, ESG stands for Environment, Social, and Corporate Governance. This is a movement where investors, individuals and institutions primarily invest in stocks that not only deliver a handsome financial gain, but also generates a positive social and measurable environmental impact – the best of both worlds. ESG investing considers variables or factors that are beyond the financials. Accountable investors assess companies based on the ESG criteria to decide on the risk-return framework.

ESG Investing has various connotations such as Impact Investing or Socially Responsible Investing. According to the GIIN annual survey 2020, the global impact investing market has grown from $25.4 million to $715 billion between 2013 and 2019 at a 27% CAGR.

For some investors the easiest way to gain exposure to ESG Investing is through ESG/sustainable ETFs ETFs or Impact ETFs. These ETFs have exposure to a portfolio of companies that meet their respective index investment objectives such as ESG rating and various fundamental criteria. For instance, S&P 500 ESG Index is a market-cap-weighted index that tracks the performance of stocks complying with the sustainability criteria of the S&P 500 companies. On the other hand, some also prefer the Fixed Income route and invest in ESG Bonds.

Whatever the method, it is amply evident that ESG Investing has finally arrived and has become a mainstream theme in 2020. Here’s a look at some of the data to illustrate this.

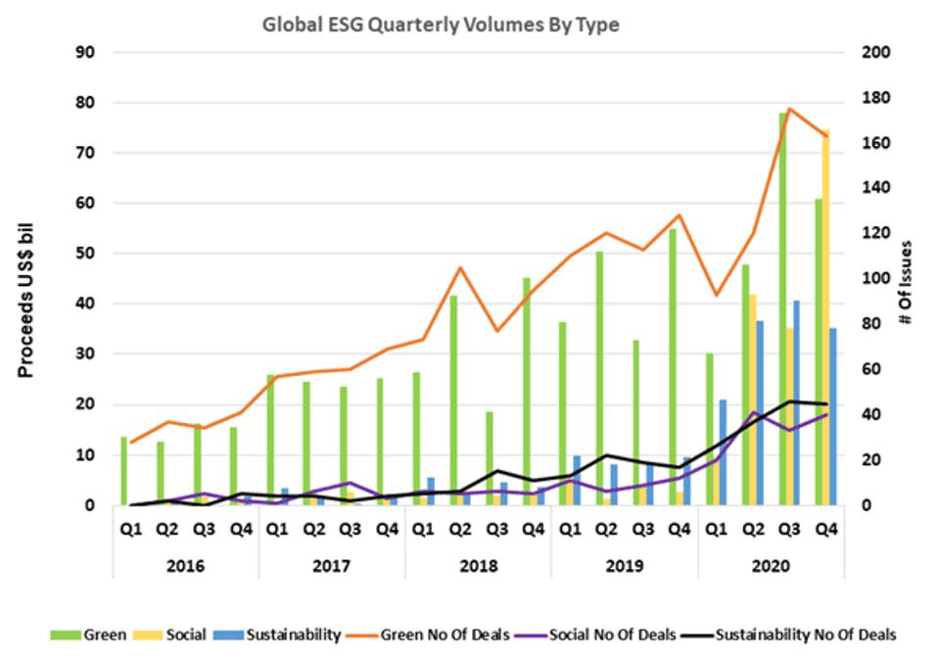

According to the latest Refinitiv data ESG Bonds have reached a record high at over $489 billion in 2020.

On the equity front, a research by Fidelity shows that stocks which had a higher ESG rating enjoyed better returns in every month of 2020. Fidelity conducted a monthly returns analysis for the first nine months of 2020, comparing it to the MSCI AC World index. The study revealed that better ESG-rated stocks, the As and Bs, had higher returns than poorly rated stocks Ds & Es in all months of 2020, except April.

Source: Fidelity

Why is it important or gaining popularity?

The glaring data about ESG Investing in 2020 brings us to the pertinent question as to why is this investment theme gaining so much prominence. Covid-19 was also a major game changer for ESG investing as the pandemic placed focus on the social and governance issues. Investors keenly judged the response of companies on these fronts in the wake of a crisis.

A major change in the profile of investors signifying increased participation by millennials and females have also boosted ESG Investing. This shift in investor demography called for value-added investments that scores high on sustainability and social accountability. A survey by Blackrock revealed that 67% of millennials and 76% of women wanted investments to be aligned to their social and environmental values.

- ESG-Compliant companies are more stable: In the long-run, companies that adhere to the ESG norms are likely to give better returns as compared to those that are non-compliant. Companies that do no put lay emphasis on their ESG credentials are exposed to risks such as labor strikes, higher cost of capital, fraudulent dealings, increased environmental regulations, etc. All these factors are bound to have a bearing on the company’s market standing and financial performance. According to an MSCI report, companies that enhanced their ESG compliance have outperformed by 14.4% in the emerging markets over a five-year period. In developed markets, it has outperformed by 5.2%.

- Sustainable way of investing: Companies that are compliant to ESG investing are never short-term attractions. Their way of working ensures that they remain in business for long on account of value creation. Investors who adopt a long term approach are able to surmount periodic volatility and result in formidable wealth creation. ESG Investing is also an excellent way to diversify your portfolio and distribute your risks.

What are the prospects of ESG Investing?

The appeal of ESG Investing’s is likely to continue. According to BofA Securities, “ESG investing would enjoy continued momentum after a “banner year” in 2020 and investors will be more nuanced in their approach to ESG. “

Three major trends dominating ESG Investing next year

- Focus on Green Investing:

Joe Biden’s win in the Presidential election has boosted the prospects of adoption of green energy in times to come. The President-elect is ready to pump in $2 trillion into green energy and this is going to be a turning point for the ESG theme. Widespread adoption of alternative energy is going to be one of the major tenets of ESG investing and is likely to attract a lot of investors. According to MSCI, “Climate change will be a ‘really big’ focus for ESG investors.”

- Investors to look for diversity in businesses

Diversity among employees is going to be a critical factor. Investors wouldn’t be willing to invest in companies that aren’t inclusive in their employment policies. Diversity at leadership level whether in terms of gender, race or physical abilities will be a highly sought-after factor by investors. Hence, we can start seeing companies boost their diversity programs to gain acceptability on the ESG front.

- Data to ease investor worries on ESG Reporting

One of the biggest concerns of investors in impact theme is the standardization of ESG data reporting by companies. We can see highly disruptive technologies to streamline the data analysis process. There would be a lot of advanced methods to automate and streamline the data collection and analysis process. Thus leaving minimal chances for investors to be fooled by companies who confuse them in the name of ESG reporting.

Bottom line

To reap complete benefits of ESG Investing, you should have clarity about your goals and your inclination towards the non-financial aspects of your investments. Before taking a plunge sit down with your advisor and obtain a detailed understanding of ESG reporting so that you can make informed decisions. You must also be careful about selecting the degree of ESG integration that you want in your portfolio. ESG investing is surely expected to gather increased momentum. However, as an investor, you need to ensure that it doesn’t impact your risk framework and your basic asset-allocation adversely.